Finance is a fundamental requirement for businesses to operate, grow, and innovate. Every organization needs funds for daily operations, long-term investments, and unforeseen challenges. The ability to secure the right type and amount of finance at the right time can significantly influence a business’s success. Sources of finance can be broadly categorized into internal and external, with each category offering specific benefits and challenges. This article provides a detailed explanation of the types of financial sources, along with their advantages and disadvantages, to help businesses make informed decisions.

Types of Sources of Finance

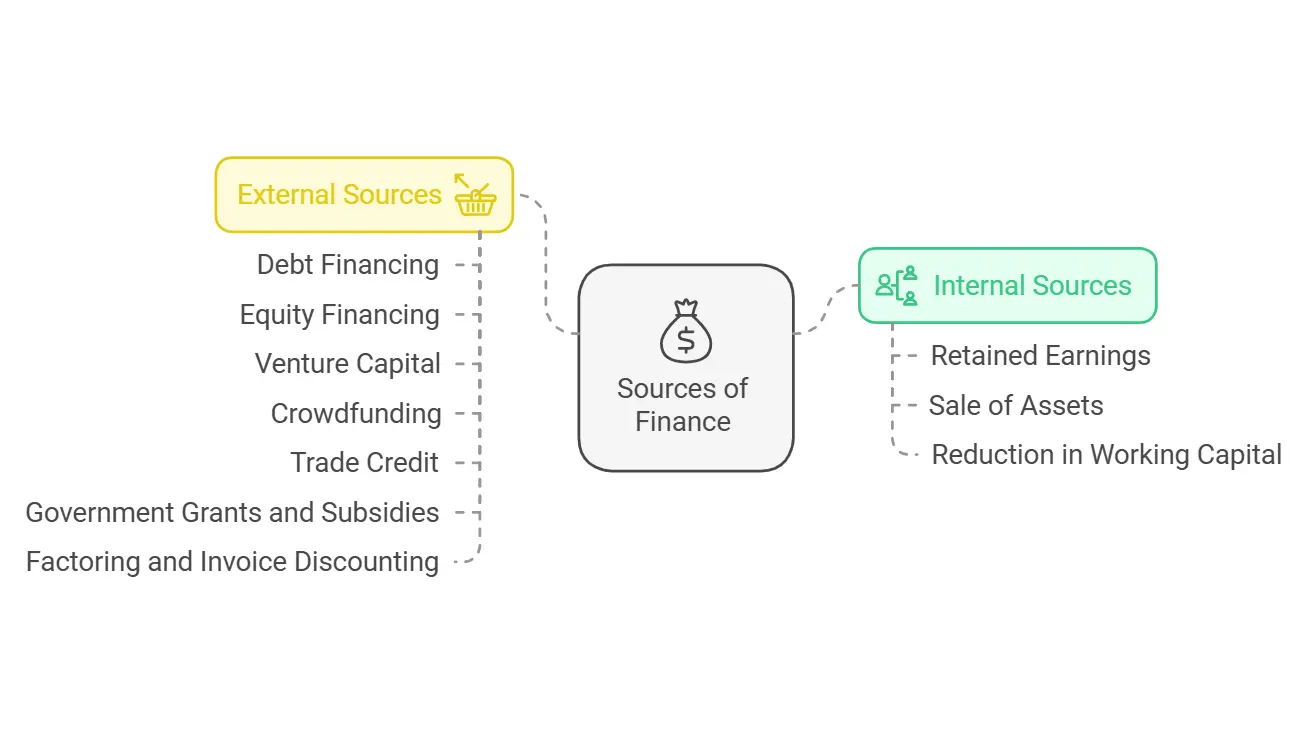

The types of sources of finance can be broadly categorized into internal and external sources, each serving distinct financial needs. Internal sources involve utilizing funds generated within the business, such as retained earnings, sale of assets, or optimization of working capital. These sources are cost-effective as they do not increase liabilities or dilute ownership. On the other hand, external sources involve obtaining funds from outside the organization, including equity financing, debt financing, venture capital, crowdfunding, trade credit, and government grants. These external options provide businesses with access to larger sums of capital and are essential for significant investments or expansion. Each type of source comes with its unique advantages and challenges, making it vital for businesses to evaluate their specific requirements and strategic goals when choosing the most suitable option.

1. Internal Sources of Finance

Internal sources involve utilizing resources already available within the business. These sources are often preferred because they do not create additional liabilities or dilute ownership.

a. Retained Earnings

Retained earnings are the profits that a company keeps after paying dividends to shareholders. These funds are reinvested into the business to finance expansion, purchase assets, or support working capital.

- Advantages:

- Cost-Effective: Retained earnings do not involve interest payments or issuance costs, making them an economical source of finance.

- No Repayment Obligation: Unlike loans or bonds, retained earnings do not need to be repaid.

- No Ownership Dilution: Existing shareholders’ control is preserved since no new shares are issued.

- Disadvantages:

- Limited Funds: The availability of retained earnings depends on the company’s profitability. If profits are low, this source becomes insufficient.

- Opportunity Cost: Retaining earnings might reduce funds available for dividend distribution, potentially dissatisfying shareholders.

b. Sale of Assets

Businesses can sell unused or underutilized assets, such as old machinery, vehicles, or real estate, to generate funds. This method is particularly useful during financial constraints.

- Advantages:

- Immediate Liquidity: Assets can be sold quickly to address urgent financial needs.

- No Additional Debt: Selling assets avoids the need to borrow funds and accrue interest.

- Disadvantages:

- Finite Resource: Businesses can only sell assets once, limiting the long-term viability of this approach.

- Operational Impact: Selling core assets might affect production capacity or overall efficiency.

c. Reduction in Working Capital

Optimizing working capital by reducing excess inventory, speeding up receivables collection, or delaying payables can free up funds for other uses.

- Advantages:

- Improved Cash Flow: Better working capital management enhances liquidity.

- Cost Saving: Reducing inventory carrying costs can lead to significant savings.

- Disadvantages:

- Risk to Operations: Excessive reduction in inventory or extended credit periods might disrupt business operations or strain supplier relationships.

2. External Sources of Finance

External sources involve acquiring funds from outside the organization. These sources are typically used when internal resources are insufficient to meet financial needs. External financing can be classified into equity financing, debt financing, and alternative methods.

a. Equity Financing

Equity financing involves raising capital by selling shares of the company to investors. Shareholders gain partial ownership and may receive dividends based on company performance.

- Types of Equity Financing:

- Ordinary Shares: Offer ownership rights and voting privileges. Shareholders receive dividends, but only after all other financial obligations are met.

- Preference Shares: Provide fixed dividend payments and are prioritized over ordinary shares during liquidation.

- Advantages:

- No Repayment: Unlike loans, equity financing does not involve repayment obligations, reducing financial strain.

- Risk Sharing: Shareholders bear the risk of business failure, providing financial relief to the company.

- Large Capital Access: Equity financing can raise substantial funds, especially for large-scale projects.

- Disadvantages:

- Ownership Dilution: Issuing shares reduces the existing shareholders’ control over the company.

- Higher Cost: Dividend payments, especially for preference shares, can be costlier than interest payments on loans.

- Regulatory Compliance: Issuing shares requires adherence to legal and regulatory requirements, which can be time-consuming and expensive.

b. Debt Financing

Debt financing involves borrowing funds that must be repaid over time, usually with interest. This is a common choice for businesses needing predictable financing.

- Types of Debt Financing:

- Bank Loans: Businesses borrow a lump sum or credit line for a specific purpose and repay it in installments with interest.

- Debentures: Long-term debt instruments that provide fixed returns to investors.

- Bonds: Debt securities issued by corporations or governments, often offering convertibility features.

- Advantages:

- Ownership Retention: Debt does not dilute ownership, allowing original owners to retain control.

- Predictable Costs: Fixed interest payments enable better financial planning.

- Tax Benefits: Interest payments on debt are tax-deductible, reducing the overall cost of borrowing.

- Disadvantages:

- Repayment Pressure: Regular repayment schedules can strain cash flows, especially during slow business periods.

- Risk of Default: Failure to meet debt obligations can lead to legal consequences or insolvency.

- Interest Costs: High-interest rates can increase the cost of borrowing significantly.

c. Venture Capital

Venture capital firms provide funding to startups and high-growth companies in exchange for equity. They also offer guidance and mentorship to the business.

- Advantages:

- Access to Expertise: Venture capitalists bring valuable industry knowledge and networks.

- No Immediate Repayment: Unlike loans, venture capital funding does not require monthly repayments.

- Supports High-Risk Ventures: Ideal for innovative startups with significant growth potential.

- Disadvantages:

- Significant Ownership Dilution: Venture capitalists often demand a substantial equity stake.

- High Expectations: Investors expect high returns and aggressive growth.

- Loss of Independence: Venture capitalists may influence strategic decisions, reducing entrepreneurial autonomy.

d. Crowdfunding

Crowdfunding involves raising small amounts of money from a large group of people, typically through online platforms.

- Advantages:

- Wide Audience Reach: Crowdfunding platforms provide access to a global pool of potential investors.

- Market Validation: Successful campaigns demonstrate market interest in the product or idea.

- No Repayment: Many crowdfunding models, such as rewards-based funding, do not require repayment.

- Disadvantages:

- Uncertain Results: Reaching funding goals is not guaranteed, and campaigns may fail.

- Marketing Effort: Successful crowdfunding requires substantial promotion and engagement with potential backers.

- Reputation Risk: A failed campaign might harm the company’s reputation.

e. Trade Credit

Trade credit allows businesses to buy goods or services from suppliers on credit, with payment deferred to a later date.

- Advantages:

- Improves Cash Flow: Deferred payments enable businesses to use cash for other purposes.

- Interest-Free: In most cases, trade credit does not involve interest costs.

- Strengthens Supplier Relationships: Regular use of trade credit can lead to better terms over time.

- Disadvantages:

- Limited Credit Period: Short credit terms might not be sufficient for long production cycles.

- Potential Penalties: Delayed payments can result in penalties or strained supplier relationships.

f. Government Grants and Subsidies

Governments offer financial support to encourage specific industries, projects, or regions.

- Advantages:

- No Repayment: Grants and subsidies do not need to be repaid, reducing financial pressure.

- Encourages Innovation: Government funding often supports R&D and innovative projects.

- Reduces Costs: Subsidies lower the cost of production, increasing profitability.

- Disadvantages:

- Application Process: Securing grants often involves lengthy and competitive processes.

- Usage Restrictions: Funds must be used for specified purposes, limiting flexibility.

- Limited Availability: Not all businesses or industries qualify for government funding.

g. Factoring and Invoice Discounting

These methods allow businesses to convert receivables into immediate cash by selling invoices to a factoring company or using them as collateral for loans.

- Advantages:

- Improves Liquidity: Provides quick access to cash without waiting for customers to pay.

- Reduces Risk: Shifts the risk of bad debts to the factoring company.

- Disadvantages:

- High Costs: Factoring fees can be significant, reducing profitability.

- Customer Perception: Clients may view factoring as a sign of financial instability.

Advantages of Using Multiple Sources of Finance

- Flexibility: Diversifying funding sources allows businesses to adapt to changing financial needs.

- Risk Mitigation: Reduces dependency on a single source, minimizing financial risks.

- Cost Optimization: Businesses can choose cost-effective options based on current market conditions.

- Scalability: Different sources support various growth stages, from startups to mature businesses.

- Enhanced Credibility: Access to diverse funding improves the organization’s reputation among stakeholders.

Disadvantages of Using Multiple Sources of Finance

- Complexity: Managing multiple funding sources requires detailed planning and oversight.

- Cost Overruns: Hidden costs such as fees, interest, or administrative expenses can escalate.

- Ownership Dilution: Equity financing reduces control and decision-making authority.

- Debt Burden: Excessive reliance on debt increases financial vulnerability.

- Regulatory Compliance: Different sources come with varied compliance requirements, increasing the administrative workload.

Choosing the Right Source of Finance

The choice of financing depends on several factors:

- Nature and Size of the Business: Large-scale operations may require a mix of equity and debt, while small businesses may rely on internal sources.

- Purpose of Funding: Long-term investments often require equity or long-term debt, while short-term needs may be met through trade credit or working capital loans.

- Cost of Capital: Businesses should evaluate the cost of financing and choose the most economical option.

- Risk Appetite: Organizations must balance risk and return when selecting sources of finance.

For More Content Check Out :- KMBN 302

Conclusion

Selecting the right source of finance is a strategic decision that can significantly impact an organization’s growth and sustainability. Internal sources like retained earnings and asset sales are cost-effective but limited, while external sources like equity, debt, and crowdfunding offer greater flexibility but come with associated risks and costs. A thorough understanding of the advantages and disadvantages of each source is essential for effective financial planning. By leveraging an appropriate mix of funding options, businesses can achieve their operational and strategic objectives efficiently.